Traveling Right Now? Worry Not! Here Are A Few Tips To Travel Cashless #NoteBan

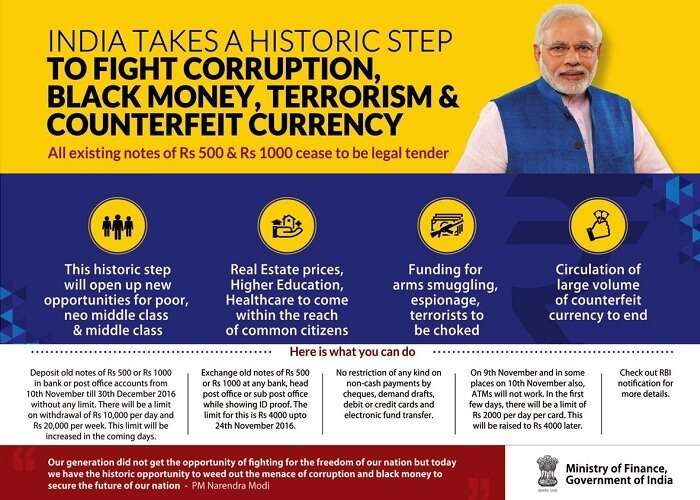

All currency denominations of INR 500 & INR 1000 ceased to be legal tenders, effective 9th November 2016. Following the surprise move by the Ministry of Finance & RBI, Honorable Prime Minister Narendra Modi announced that the currently floating Rs 500 & Rs 1000 notes will be replaced by new currency bills of INR 500 & INR 2000. The bold step that has been taken to fight the problem of black money, counterfeit currency, and corruption will also accelerate the move to a cashless economy.

While the country still debates on the impact of this bold & historic step, we would like to draw your focus on the impact of the demonetization on those currently on a holiday and those planning one.

How will the demonetization of the 500 & 1000 bills affect travel?

Effects on inbound travelers

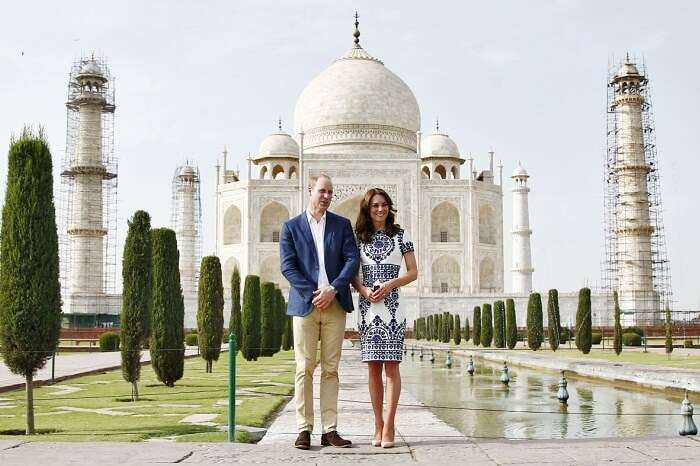

The foreigners coming to India during the 50-day period or those who are already touring the nation are likely to face the following problem of currency.

With the new currency bills coming into the market, it is only safe to be apprehensive of the supply of money. To begin with, there will be a problem of exchanging their home currency into higher denominations of Indian currency during the entire period. For those who already have the older bills of INR 500 & INR 1000, the exchange will be all the more troublesome. And let us not ignore the impact of bank closures that will prevent them from exchanging older bills altogether.

And we are not just talking about the basic expenses of food, local travel, and shopping. In case the foreigner hasn’t already paid for hotels and sightseeing packages, the travel woes are more likely to increase.

The online respite that is offered to the inbound travelers is the acceptance of old bills for air and railway tickets until 11th November, in addition to the exceptions mentioned already.

Effects on outbound travelers

For those considering to travel abroad from India before 30th December 2016, the following travel problems may be present:

a. Currency

Most travelers find it convenient to exchange cash to cash on forex markets. But with the limit on withdrawal and the demonetization of previously existing INR 500 & INR 1000 notes, the exchange would be difficult. Of course there are credit/debit cards and forex cards.

And in case the destination chosen is a little offbeat with lesser facilities of onsite exchanges and ATMs, the problem is surely going to increase manifolds.

b. Bookings

Things might not work out for those who have been planning to book foreign packages through local agents on cash payment basis. But it is going to be a much smoother ride for those who plan on booking international tour packages online.

c. Flights and VISA

Until 11th November, the old currency bills might be accepted for flight bookings. But those planning on booking flights and obtaining tourist VISA through local agents on cash payment basis are sure to face problems in these days to come.

d. Shopping

Shopping in foreign destination would need cash, especially at the street side vendors selling souvenirs. This brings us back to the question of cash woes for the outbound travelers.

Suggested Read: INFOGRAPHIC- 24 Amazing International Vacations Indians Can Take Without A Visa

Effects on domestic travelers

The Indians who are already traveling in India or those who intend to go on a holiday to an Indian destination during 9th November – 30th December 2016 might come across the following travel issues:

a. Bookings

With the current demonetization, problems will continue to persist for those who have been looking to buy packages from local agents and pay through cash. The same can be avoided by booking Indian holiday packages online.

b. Payments

Those who are currently on tour will find it very difficult to pay in cash with the 2-day bank & ATM unavailability. And in offbeat destinations like Kasol, where there are no ATMs altogether, it is going to be really tough. We suggest you to pay online as much as possible or carry cash in lower denominations.

To conclude safely, the step aimed to curb black money and corruption may pose some worries for the travelers. But the paperless transactions and efficient planning can eliminate these travel woes.

But before we take your leave, we present to you a summary of the event that shook the nation.

Key Points From PM Narendra Modi’s Address

Until 11th November 2016:

- Government hospitals, chemists, and dispensaries will continue to accept the old INR 500 & INR 1000 bills for payments.

- Ticket booking counters of airlines, railways, and government buses will accept the old currencies for the purchase of the respective tickets.

- Petrol, diesel, & gas stations run by PSUs will continue to accept old notes.

- Government authorized milk booths and consumers’ cooperative stores authorized by state/central governments will also accept the old notes.

- The old currency notes will also be acceptable at crematoria and burial grounds.

- The old currency notes can be exchanged for other currency notes while leaving or entering the country.

Note: Following the news of demonetization, DMRC announced on 9th November that it will also accept old currency bills.

Regarding the exchange of old currency notes:

- The public can deposit the old notes of INR 500 & INR 1000 at banks and post offices until 30th December 2016 without any limit. However, a penalty will be imposed if the deposit exceeds the income.

- Beyond 30th December 2016, the public can deposit the old notes with RBI and other authorised exchange centres by producing an ID proof and a self-attested application.

- ATMs and banks will be closed on 9th & 10th November 2016.

- Withdrawal from bank will be limited to INR 10,000 per day and INR 20,000 per week. The limit is expected to increase after a few days.

- Old notes of value amounting upto INR 4000 can be exchanged at any bank or head post office or sub-post office on showing the ID proof until 24th November 2016.

- There will be no restriction whatsoever on non-cash payments, such as cheques, demand drafts, credit cards, NEFT, IMPS, and RTGS.

Note: For further information, check the FAQ section of RBI.

What do the new Rs 2000 & Rs 500 notes look like?

The new INR 500 note that will be issued

Features of the new INR 500 note:

- Base color: Stone Grey

- Motif on the rear: Red Fort in Delhi

- The currency value is written in Hindi and English; not just in words, but also in numerals.

- The currency value in numerals on the front side is green color that turns blue in light.

- It has the logo of Swachh Bharat on it.

- There are raised letters and numerals on the currency bill to assist the visually impaired people to read on Braille.

The new INR 2000 note that will be issued

Features of the new INR 2000 note:

- Base color: Magenta

- Motif on the rear: Mangalyaan; India’s first venture in interplanetary space

- The currency value is written in Hindi and English; not just in words, but also in numerals.

- The currency value in numerals on the front side is green color that turns blue in light.

- It has the logo of Swachh Bharat on it.

- There are raised letters and numerals on the currency bill to assist the visually impaired people to read on Braille.

As the nation fights the problem of black money and corruption, only time will tell about the impact of these measures. Until then, good luck and bon voyage!

Further Read: If These Mind Blowing Facts Don’t Make You Feel Proud To Be An Indian, Nothing Will!

Kushal is a communication strategist, with 5+ years of experience in creating communication for diverse industries. His passion for helping the readers comes from his prior experience of running a travel agency with his dad. And he does that by addressing the actual travelers’ pain points in his blogs. And his work at TravelTriangle has also earned him multiple invites to speak about travel blogging at conferences & seminars. When he is not creating marketing strategies or content, he can be found reading about Harry Potter, DC, Marvel, or other anime. Find him on other social media channels here: